I am a bivio club member who also writes on various investment topics. Laurie has indicated that some of you might be interested in reading some of my thoughts and I have agreed to share them here with you from time to time.

As a little background on myself, I am the editor/contributor of the New Low Observer (www.newlowobserver.com), an online investment newsletter. The primary goal of the site is to provide insight on investing in dividend paying stocks. However, as part of the research that is done for the website, I cover many topics from commodities to technology stocks. I have been a consistent contributor to SeekingAlpha.com since March 2008.

I have studied economics at Cal State East Bay and I have a professional background of working at the Federal Reserve Bank of San Francisco, Bear Stearns, along with subcontract work for Fannie Mae and Freddie Mac in the area of loss mitigation from 2001 to 2010 (before and after the housing crisis).

Below is an article on utilities during a strictly rising interest rate environment (1939-1980) posted to my website on September 4, 2014. I'd be interested to hear what you think of my ideas and whether there are other topics you might find it interesting for me to write about. Enjoy.

Utility Stocks and Rising Interest Rates

Every stock market investor should be concerned about the impact that rising interest rates might have on future investment returns. The prevailing theory is that when interest rates rise then stock prices should decline due to the impact to earnings from higher borrowing costs. Since we are at or near the lowest level in interest rates, conventional wisdom suggests that eventually interest rates will rise.

With rising interest rates, investors should expect that stock prices will decline as per share earnings are reduced. One industry that borrows heavily for going operations is the utility sector (electricity, water, gas etc.). This article will give a cursory examination of utility stocks from the beginning of a rising interest rate cycle to the peak (1939 to 1980). We will attempt to determine if the conventional thinking on rising interest rates and their impact on utility stocks is correct.

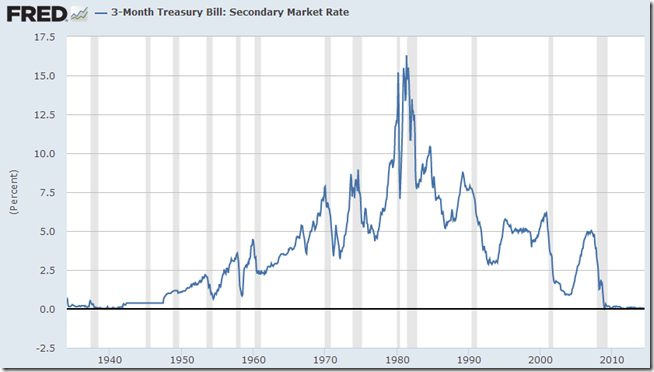

Interest Rates: 1934-2014

To better understand where we are with interest rates, we have included the following 3-month Treasury chart from January 1934 to July 2014 (source: St. Louis Federal Reserve).

An individual does not need to believe in cycle theory to understand why most investment professionals expect interest rates to rises. However, what has been the actual impact of rising interest rates on utility stock in the period when interest rates were at what could be considered the equivalent stage in the interest rate cycle? In this regards, we will review what happened to the Dow Jones Utility Average from 1939 to 1980. This is a time when the 3-month Treasury rate increased from 0.02% to 15.49%.

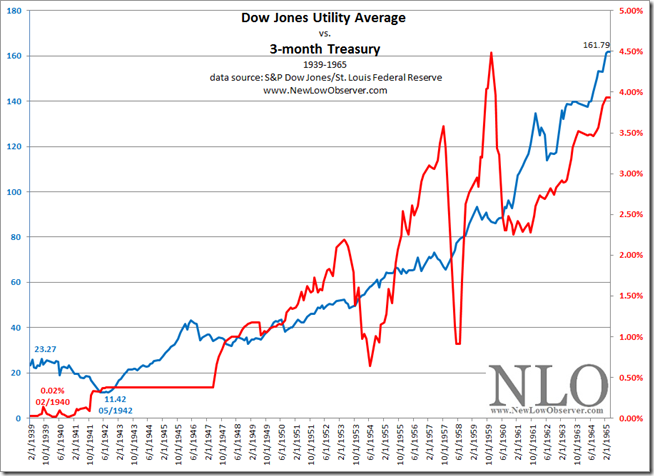

Dow Jones Utility Average: 1939-1965

The chart below depicts the impact that rising interests had on the Dow Jones Utility Average from 1939 to 1965.

The above graph should answer all questions about the impact of rising rates on utility stocks, at least in the initial stages. From February 1939, the Dow Jones Utility Average generated annualized returns of +7.74% (excluding dividends and reinvestment) by the 1965 high. Measuring from the low in the Dow Jones Utility Average in May 1942, the annualized return jumped to +10.73%. The performance of the Utility Average mirrors the performance of the Dow Jones Industrial Average as the index increased nearly 10 times as outlined in our April 21, 2011 article titled "The Myth of 'Inflation Proof' Stocks".

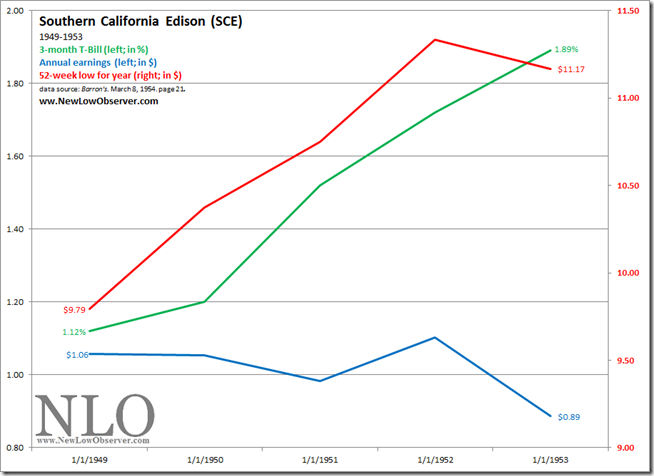

Apparently, rising interest rates don't impact utility stocks as much as anticipated. To punctuate this point is the charting of individual utility stock data from within the rising interest rate cycle of 1940 to 1980. Below is a chart of Southern California Edison (SCE) from 1949 to 1953.

In the chart above, we can see that the 3-month Treasury increased from 1.12% to 1.89%. At the same time, the earnings for SCE generally declined. Despite this fact, declining earnings (-16%) and increasing interest rates (+68%), SCE experienced a +14% increase in the 52-week low from 1949 to 1953. In addition, the annual range in the stock price, from the low to the high, averaged +15%. The stock price performance and along with decreased earnings and increased interest rates defies much of the conventional wisdom on what to expect as rates climb, especially for utilities.

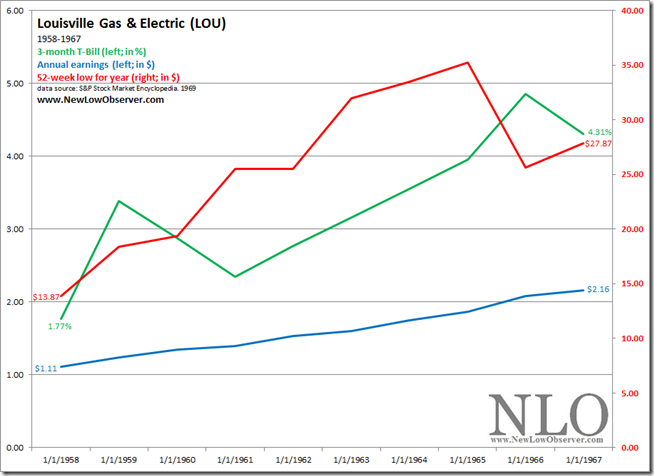

The experience of SCE may have been a one-off event, which was caused by investors willing to blindly ignore the reality of declining earnings. Because of this concern, we reviewed other utility stocks that could give a contrasting perspective. In this case, we have selected six utility stocks in a period when interest rates increased nearly two and a half times (2.43x), in different geographic regions in the United State from 1958 to 1967.

The first stock is Louisville Gas & Electric (LOU) headquartered in Louisville, Kentucky. From 1958 to 1967, LOU saw the 52-week low increased by +100%.

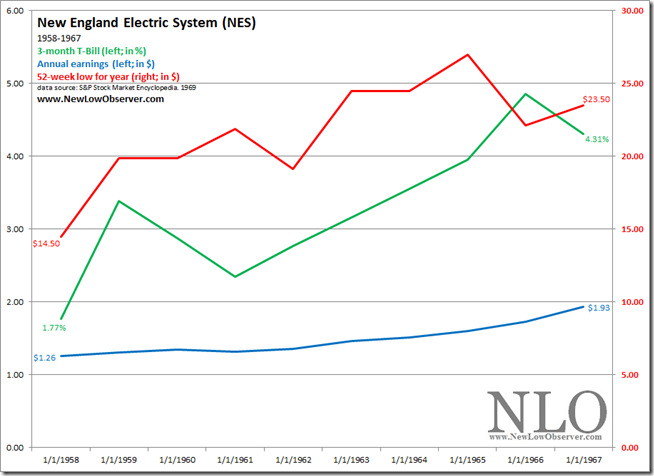

The next stock is New England Electric System (NES) headquartered in Boston, Massachusetts. The 52-week low for NES increased +60% while earnings increased by +53%.

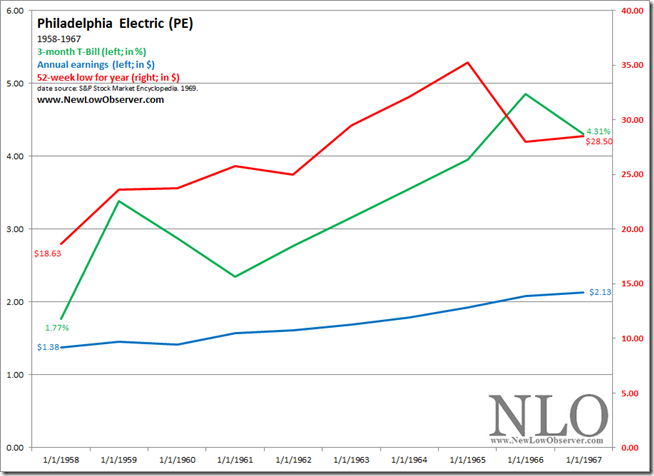

Representing Philadelphia, Pennsylvania is Philadelphia Electric (PE). The 52-low increased +52% while earnings increased +54% from beginning to end.

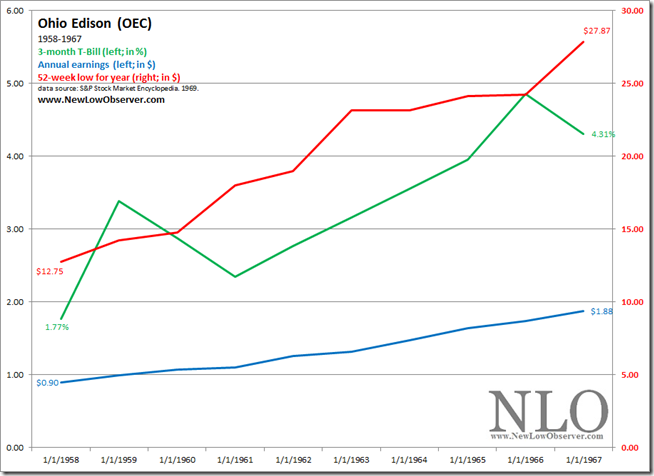

The next company is Ohio Edison (OEC) headquartered in Akron, Ohio. OEC saw 52-week low increase +118% while earnings doubled.

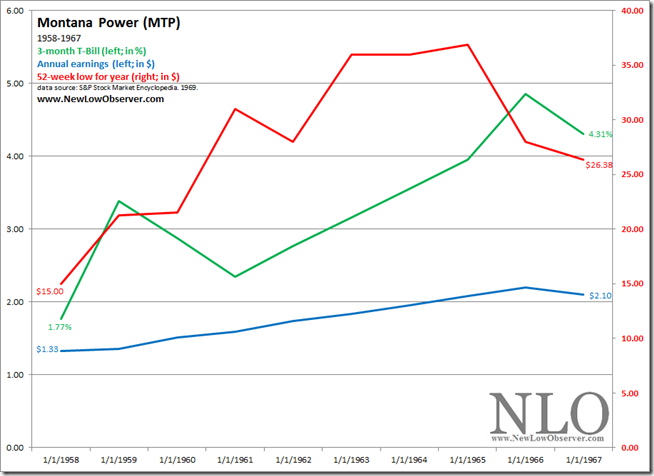

The next utility is Montana Power (MTP) located in Butte, Montana. MTP increased earnings by only +57% yet the 52-low for the stock price rose +75%.

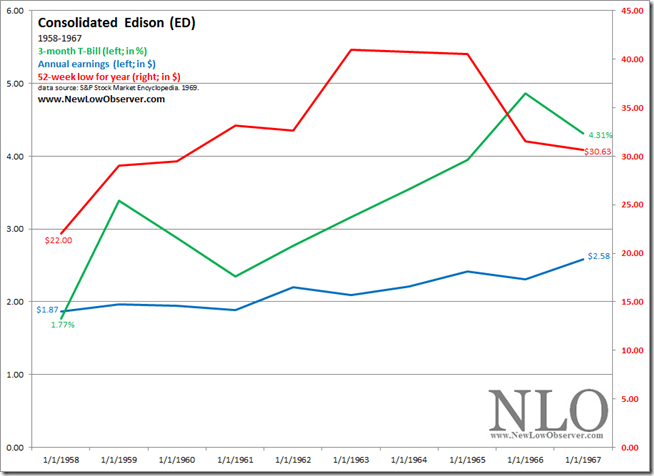

Finally, we have Consolidated Edison (ED) out of New York City. ConEd gained a modest +39% in the 52-week low while earnings increased +38%.

Based on the earnings performance of the individual stocks, we can see that the price change in the Dow Jones Utility Index was consistent with investor expectations until the 1965 peak. All of the above performance data is within a period (1939-1965) when interest rates increased dramatically. An essential consideration is not whether rates increased but where the increase started. This point about relative change is made clear in a July 10, 2014 article titled "What You Need to Know About Rising Interest Rates" by David Eifrig Jr.

Dow Jones Utility Average: 1965-1980

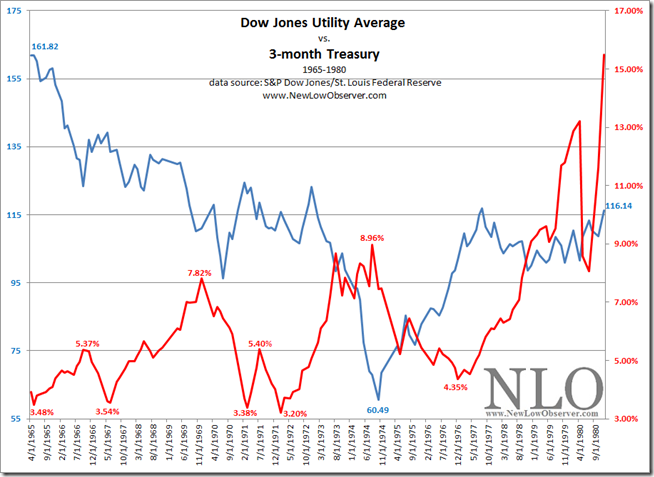

The wrath of interest rates was eventually felt in the period that followed the peak in the Dow Jones Utility Average. Surprisingly, it was the period when interest rates fluctuated in a rather wide range that the utility index took the most dramatic decline. As seen in the chart below, the 3-month Treasury vacillated widely in the period from 1965 to 1976.

Our interpretation of the decline in the Utility Average from 1965 to 1976 is that, due to the uncertainty in interest rates, it was difficult for utility management to project earnings with any level of confidence. Investors responded to this uncertainty by selling even though there were pockets of significant interest rate declines. As pointed out in the July 14, 2014 article titled "Utilities and Rising Interest Rates: Fact or Fiction?" by George Fisher, rising rates might be the least of the worries for utility stock investors, instead "...Shareholder problems lie in the down cycle." This was definitely the case in the declining rates from November 1966 to June 1967, December 1969 to February 1971, July 1971 to February 1972 and August 1973 to October 1974.

After 1976, in spite of the continued trend in rising interest rates, management projection of earnings was based on a worst case scenario of rising rates. As this rising rate trend transpired, investor expectations were more or less in line with what was to come. This may explain the near doubling of the Utility Average from 1974 to 1980, as investors anticipated a continuation of the rising rate trend.

Conclusion

Investors anticipating a general rise in interest rates should feel some comfort in knowing that most manager in the utility sector are ready for what is to come. Rising interest rates are not an automatic death sentence for utility stock prices or earnings. In fact, the early stages of rising interest rates may see utility stocks match or exceed the returns of non-interest rate sensitive stocks, on a total return basis. Only when the outlook is cloudy will it become difficult to offer projections that are in line with prior expectations.