a

State income tax filing requirements for investment clubs are complex to determine. There is no standard method across states of describing the circumstances that might require a club to file a state partnership return. Because of this, we cannot claim expertise for all state income tax requirements. We don't want to have you go to the expense and hassle of filing a return if it isn't really necessary, but we can't guarantee the notation here will be applicable to all clubs. We provide it to you as an aid only. It should be accurate for a small investment club who has stayed within the investing guidelines we provide, but it may be incorrect depending on your club circumstances. For example, if your club has invested in any sort of partnership this list will not be applicable. If your club has many members or a large valuation or income for the year special circumstances may also apply to you. To make a final determination, you are welcome to email us to discuss your situation. But your best answer will come from checking with an accountant who practices in your state of residence. They can assess your club circumstances and give you the best answer on whether or not your investment club needs to file state taxes. If you do, we may be able to help you prepare your state taxes most cost effectively. To find out more, contact us at: support@bivio.com to discuss your options. | Updated as of 2/19/2025

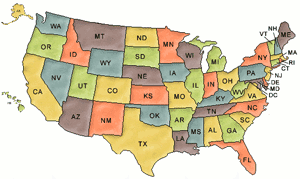

Starred states included with bivio subscription.

State - State of official club address

|