The Member Withdrawal Report is a very important report which contains information a member may need to report on his personal taxes (See Gain/(Loss) Realized on Withdrawal below).

This information is in addition to the information that will be shown on the K-1 he will also receive for the tax year. A copy of it should be given to him when he receives his withdrawal payout. An updated copy should also be given to him when he is given his K-1.

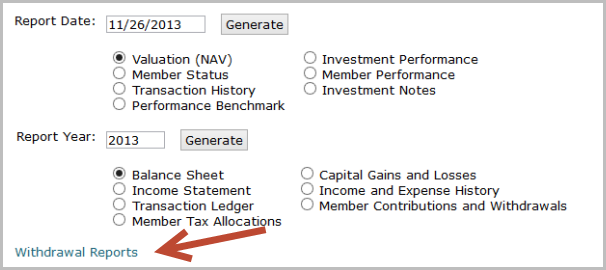

The report gives a summary of important information relating to a member withdrawal. Member withdrawal reports are found by going to the Accounting>Reports page after you enter a withdrawal . A list of all reports will be displayed when you select this link:

Click on a member's name to see his/her report. It will contain the following information:

- Transaction Date - This is the date the withdrawal is effective and the member is no longer a part of your club. It is also shown in the title of the report. As of this date, there will be no further adjustments to the number of units a member owns and he/she will no longer be allocated club club income and expenses.

- Member Valuation Date - The date on which the withdrawal unit value is established.

- Account Valuation - The withdrawing member's account value is the value of a unit as of the Member Valuation Date multiplied by the number of units the club member owns as of the Withdrawal Transaction Date.

- Member's Basis Before Withdrawal- This is the member's tax basis as of the end of the calendar year prior to the year of the withdrawal. The tax basis is the cumulative sum of the member's contributions, minus any partial withdrawals, plus any earnings allocated in prior years, and minus any deductions allocated in prior years.

- Current Income Allocation - The member's portion of the total income, interest, dividends, gains/losses, and expenses that the club has realized from the beginning of the current year up until the transaction date of the withdrawal.

Note:In the case of a partial withdrawal, this amount will not be finalized until the end of the calendar year. Amounts shown on a report generated before that should be interpreted as being preliminary.

For more information on allocations see the Member Tax Allocations Report.

- Adjusted Basis - The sum of the Member's Basis before Withdrawal and amount shown as the Current Income Allocation.

- Member's Cost Basis of Property Distributed

- Cash - The cost basis of any Cash distributed to the withdrawing member will equal the value of that cash.

- Stock -

The calculation of the withdrawing member's cost basis in any shares of Stock distributed is very complex. It may not equal the club's cost basis in the stock.

Per Internal Revenue Service (IRS) rules it is dependent on many factors including whether the withdrawal was a partial or total withdrawal, the value of the withdrawal, the value of any stock distributed and its cost basis in the hands of the club, the adjusted cost basis of the withdrawing member, and the amount of cash also distributed in the withdrawal.

Fortunately for you, bivio does the calculations for you. The member's cost basis in each lot of shares he receives is shown at the bottom of the withdrawal report.

- Total Cost Basis of Property Distributed - This is the sum of the member's cost basis of the stock received plus the amount of cash received.

- Member's Basis After Withdrawal - In the case of a Full Withdrawal, the Member's Basis After Withdrawal will always equal zero. In the case of a partial withdrawal, the member's remaining tax basis in the club will be shown here. It will be a preliminary value until the club records are closed at the end of the calendar year.

- Gain/(Loss) Realized on Withdrawal - The club member may have a taxable gain or loss as a result of his withdrawal. This is an amount in addition to any gains or losses that are allocated to him on his K-1 form. It must be included in Short term Section C on Form 8949 of his personal tax return if he has been in the club less than a year. If he has been in the club longer than a year, it will be reported in section F in the Long Term section. It will be identified as a "Disposal of partnership interest".

Note: If stock is distributed as part of the withdrawal, the withdrawn member may realize further gains or losses when the stock is sold. The withdrawal report will show his cost basis in the distributed shares. He needs to use this to determine his gain or loss when he sells the shares.

- Payout Detail -The second column shows the details of the withdrawal payout. It lists:

- Cash - The amount of Cash distributed to the member.

- Stock Value - The Fair Market Value (FMV) as of the Transfer Valuation Date of any investments distributed to the the withdrawn member

- Withdrawal Fee - If the club has charged a withdrawal fee, the amount will be listed here.

- Post-Withdrawal Adjustment - A Post Withdrawal adjustment may be shown if you enter a transaction which affects the unit value on the Member Valuation Date, but you make the entry after the withdrawal transaction has been entered.

It is an amount your club has over or underpaid the member. Once a withdrawal has been paid, there is no easy way to correct the incorrect payment. To avoid these, it is extremely important that club records be reconciled and up to date prior to entering a withdrawal.

- Withdrawal Value - This is the amount the member is actually receiving in the withdrawal.

- Investments Transferred - (if applicable) This is a detailed list of each block of stock transferred in the withdrawal. It includes everything the withdrawn member should need to determine their capital gain or loss when they eventually sell the shares.

The most important items to the withdrawn member are the Acquisition Date, the number of Shares, and the Member's Adjusted Cost Basis. These three items, along with the eventual sales price, are used to determine the capital gain or loss realized when the investment is sold and whether that gain or loss is a Long Term Capital Gain/Loss or a Short Term Capital Gain/Loss.

The Price per Share, the Market Value, and the Club's Cost Basis are provided for informational purposes only and will not be used for subsequent capital gains calculations.

Related help topics:

More questions? More Help