"Diagonals"

Hi Mark, I'm just wondering why some spreads are called "diagonal"? I just read about a strategy where you buy back a call you previously sold and at the same time sell a

different call further out in expiry and at a higher strike price. The strategy was called a diagonal call spread. Where does the "diagonal" part come into play?

If I can make the connection it will help me to remember the strategy.

Thanks! .... Deb

Hi Deb,

This is going to be easy to remember.

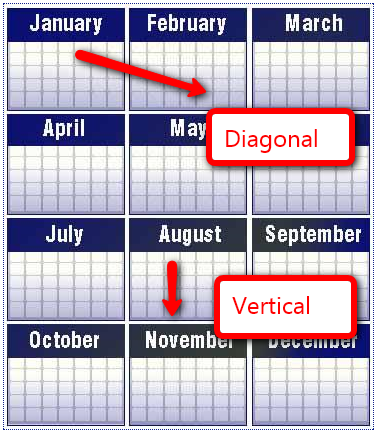

When the options are in the same month the spread is a vertical.

When they are in different months, it's a diagonal.

Why? Think of a calendar with each month in a different column.

Mark

http://blog.mdwoptions.com/Options_for_Rookies

Mark

http://blog.mdwoptions.com/Options_for_Rookies